Ammonia – the acrid-smelling chemical in cleaning products – is most widely used as an ingredient in fertiliser. It’s also being picked as a clean-burning alternative to diesel.

Clean floors, food and fuel – what’s not to love about ammonia?

Emissions. Making ammonia is a costly affair. Global emissions from its manufacture are around 2% of the world’s total GHGs.

That could change thanks to Liquium, a spinout company from Te Herenga Waka-Victoria University. Liquium’s suite of novel catalysts dramatically reduces the energy required to produce ammonia, resulting in lower capital expenditure to build plants, and lower greenhouse gas emissions.

Climate VC Fund has invested in Liquium as part of a $1.5 million seed round. The round was led by Matū Karihi Fund, with co-investors Booster Innovation Fund, Climate VC Fund, K1W1, AngelHQ, and a private angel investor. It will support the company as it scales up the technology out from the lab, preparing for beachhead market engagement.

The fund has already invested in Australian renewables tech company MGA Thermal and Auckland-based cleaning products company Cleanery.

“This is our third investment since launch this year, which shows just how many great opportunities there are in the climate tech space in New Zealand and Australia,” says Climate VC Fund director Rohan MacMahon.

Why ammonia?

Ammonia is used to make fertiliser and is attracting attention for its potential as a low-carbon fuel for shipping. However, making ammonia produces huge emissions.

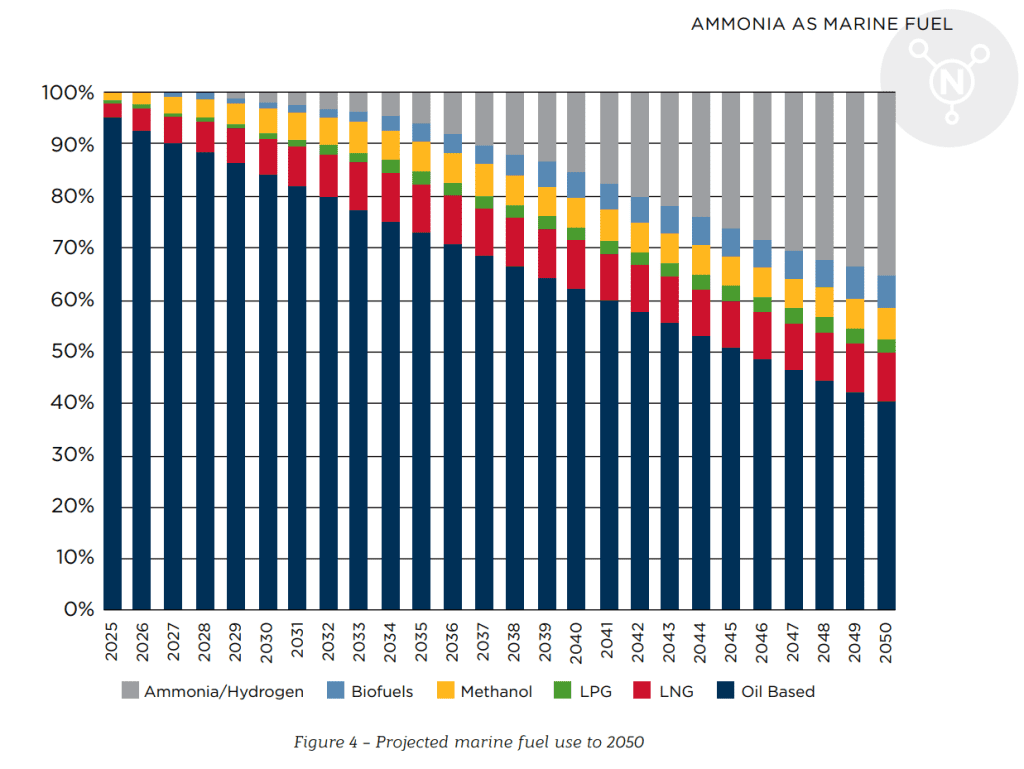

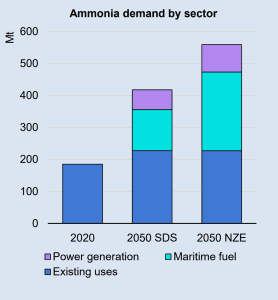

These emissions are set to increase as the world grows more food and uses more fertiliser. On top of that demand, the shipping industry is looking to decarbonise. Batteries won’t power a ship for the weeks it takes to cross oceans. Ammonia is looking like the best option for marine fuel – it can be burnt without creating carbon dioxide, is easier to store than hydrogen, and costs much less than fuel cells. If ammonia for shipping takes off, then the demand for ammonia should at least double.

Source: IEA, 2021

High emissions and growing demand mean that the ammonia industry is being pressured to decarbonise, but the current ammonia industry plans to work towards decarbonisation are woeful. The industries’ current plans for emissions reduction involve using less coal by using more gas.

Dr Jez Weston of Climate VC Fund says ammonia is an industry ripe for disruption.

“The International Energy Agency, normally very anodyne in their statements, says that the industry’s current trajectory is unsustainable. While other sectors are aiming for the Paris Agreement targets of limiting temperature increase to 1.5 or 2 degrees Celsius, the ammonia industry plans for emissions to continue increasing, just at a slower rate.

“This lack of ambition comes as the industry sees few good options for green ammonia production. Existing green ammonia production uses renewable electricity, but this has very high costs. What’s needed is a fundamental breakthrough,” says Dr Weston.

Liquium’s technology

The Liquium technology is developed out of research originating from Te Herenga Waka – Victoria University of Wellington’s School of Chemical and Physical Sciences and the MacDiarmid Institute, led by A/Prof Franck Natali and Dr Jay Chan. They are joined by Dr Paul Geraghty as CEO, rounding out a strong technical and commercial leadership team, which will grow as the company continues on their development pathway. The investors look forward to working with the team closely to support their growth and guide the development of Liquium as it continues to expand its presence in the clean energy space.

Climate VC Fund is convinced there are many more emission-busting technologies being developed in New Zealand and Australia.

“As demand for clean, low emissions solutions increases research and technology that would otherwise languish is being commercialised. We want to be the funders to make that happen,” says Rohan.

Here’s our media release:

13 July 2022

Climate VC Fund makes third investment into green tech

Fund joins seed round in Wellington start-up Liquium

Liquium, the green ammonia start-up from Te Herenga Waka – Victoria University of Wellington, has closed a seed funding round of $1.5 million – with investment from Climate Venture Capital Fund, K1W1 and other key tech investors.

“This is the third investment for Climate VC Fund since launch this year, which shows just how many great opportunities there are in the climate tech space in New Zealand and Australia,” says Climate VC Fund director Rohan MacMahon.

Liquium is a spin-out company from Wellington UniVentures. Its technology has potential to reduce greenhouse gases emitted in the production of ammonia, one of the most promising alternative fuels for shipping and other heavy industries.

The Seed Round was led by Matū Karihi Fund, with co-investors Booster Innovation Fund, the Climate VC Fund, K1W1, AngelHQ, and a private angel investor. It will support the company as it scales up the technology out from the lab, preparing for beachhead market engagement.

Why ammonia?

Ammonia is used to make fertiliser and is attracting attention for its potential as a low-carbon fuel for shipping. However, making ammonia produces huge emissions. Most production burns natural gas and coal. Global emissions from making ammonia are around 2% of the world’s greenhouse gas emissions.

These emissions are set to increase as the world grows more food and uses more fertiliser. On top of that demand, the shipping industry is looking to decarbonise. Batteries won’t power a ship for the weeks it takes to cross oceans. Ammonia is looking like the best option for marine fuel – it can be burnt without creating carbon dioxide, is easier to store than hydrogen, and costs much less than fuel cells. If ammonia for shipping takes off, then the demand for ammonia should at least double.

High emissions and growing demand mean that the ammonia industry is being pressured to decarbonise, but the current ammonia industry plans to work towards decarbonisation are woeful. The industries’ current plans for emissions reduction involve using less coal by using more gas.

Dr Jez Weston of Climate VC Fund says ammonia is an industry ripe for disruption.

“The International Energy Agency, normally very anodyne in their statements, says that the industry’s current trajectory is unsustainable. While other sectors are aiming for the Paris Agreement targets of limiting temperature increase to 1.5 or 2 degrees Celsius, the ammonia industry plans for emissions to continue increasing, just at a slower rate.

“This lack of ambition comes as the industry sees few good options for green ammonia production. Existing green ammonia production uses renewable electricity, but this has very high costs. What’s needed is a fundamental breakthrough,” says Dr Weston.

Liquium’s technology

Liquium has the potential to provide the breakthrough necessary. It has developed a suite of novel catalysts which dramatically reduce the energy required to produce ammonia, resulting in lower capital expenditure to build plants, and lower greenhouse gas emissions.

“This is just the kind of discovery-led research that Matū wants to help commercialise,” says Matū’s Venture Partner Dr Andrew Chen.

“New Zealand has an excellent science system and many researchers producing technologies that can help solve significant global problems like emissions reductions. Liquium has the potential for strong impact.”

The Liquium technology is developed out of research originating from Te Herenga Waka – Victoria University of Wellington’s School of Chemical and Physical Sciences and the MacDiarmid Institute, led by A/Prof Franck Natali and Dr Jay Chan. They are joined by Dr Paul Geraghty as CEO, rounding out a strong technical and commercial leadership team, which will grow as the company continues on their development pathway. The investors look forward to working with the team closely to support their growth and guide the development of Liquium as it continues to expand its presence in the clean energy space.

For additional comment, please contact:

Dr Jez Weston

Climate Venture Capital Fund

jez@2040ventures.com

+64 21 444 897

Dr Andrew Chen

Matu Karihi Fund

achen@matu.co.nz

+64 21 210 1531

About Wellington UniVentures – Wellington UniVentures is the Te Herenga Waka—Victoria University of Wellington company responsible for creating new for-profit and social enterprises from University research. Building on our purpose to lift lives everywhere with knowledge, Wellington UniVentures works with our University innovators to shape their research into initiatives that create impact. We do this by connecting them with partners, industry and investors to enable the growth and development of their idea or invention. With time, development and Wellington UniVentures’ support, these ideas can become life changing initiatives focused on solving problems and building stronger societies. www.wellingtonuniventures.nz

About Matū Karihi Fund – Matū is a venture capital fund investing in early-stage science and technology commercialisation from education and research institutions and the private sector. As an open and evergreen fund, Matū takes a long-term investment view and is aimed at turning ground-breaking ideas into globally focused, IP-rich companies. Matū provides intelligent capital with active governance, executive management, operational support, and mentorship for founding and executive teams: www.matu.co.nz

About Booster – Booster is one of the six government-appointed default KiwiSaver scheme providers with over 170,000 investors and $5 billion under management across KiwiSaver, Superannuation and Investment Schemes. Booster has a focus on supporting New Zealand businesses through specialist investment funds including the Booster Innovation Fund and the New Zealand Innovation Booster, which help Kiwis share in the success of innovative research and IP development by investing in the commercialisation of early-stage technologies coming out of New Zealand. www.booster.co.nz

About the Climate VC Fund – Climate VC Fund is part of 2040 Ventures, set up to invest in early stage companies with the potential to deliver high growth and material reductions in greenhouse gas emissions. The fund aims to help mitigate climate change while delivering attractive commercial returns to investors. www.climatevcfund.com

About K1W1 – K1W1 invests in New Zealand start-ups and early stage companies. Established by Sir Stephen Tindal, K1W1 has invested more than $150 million in companies across sectors such as biotech, environmental technology, electronics, software, and other high export potential businesses. www.angelassociation.co.nz/k1w1

About AngelHQ – AngelHQ is the Wellington Region’s angel investment network, connecting high net worth investors with early stage companies. AngelHQ has a strong focus on the technology sector, and has over 90 current members and a portfolio of over 100 past and current investment companies.